showcasing scholarsHIP

-

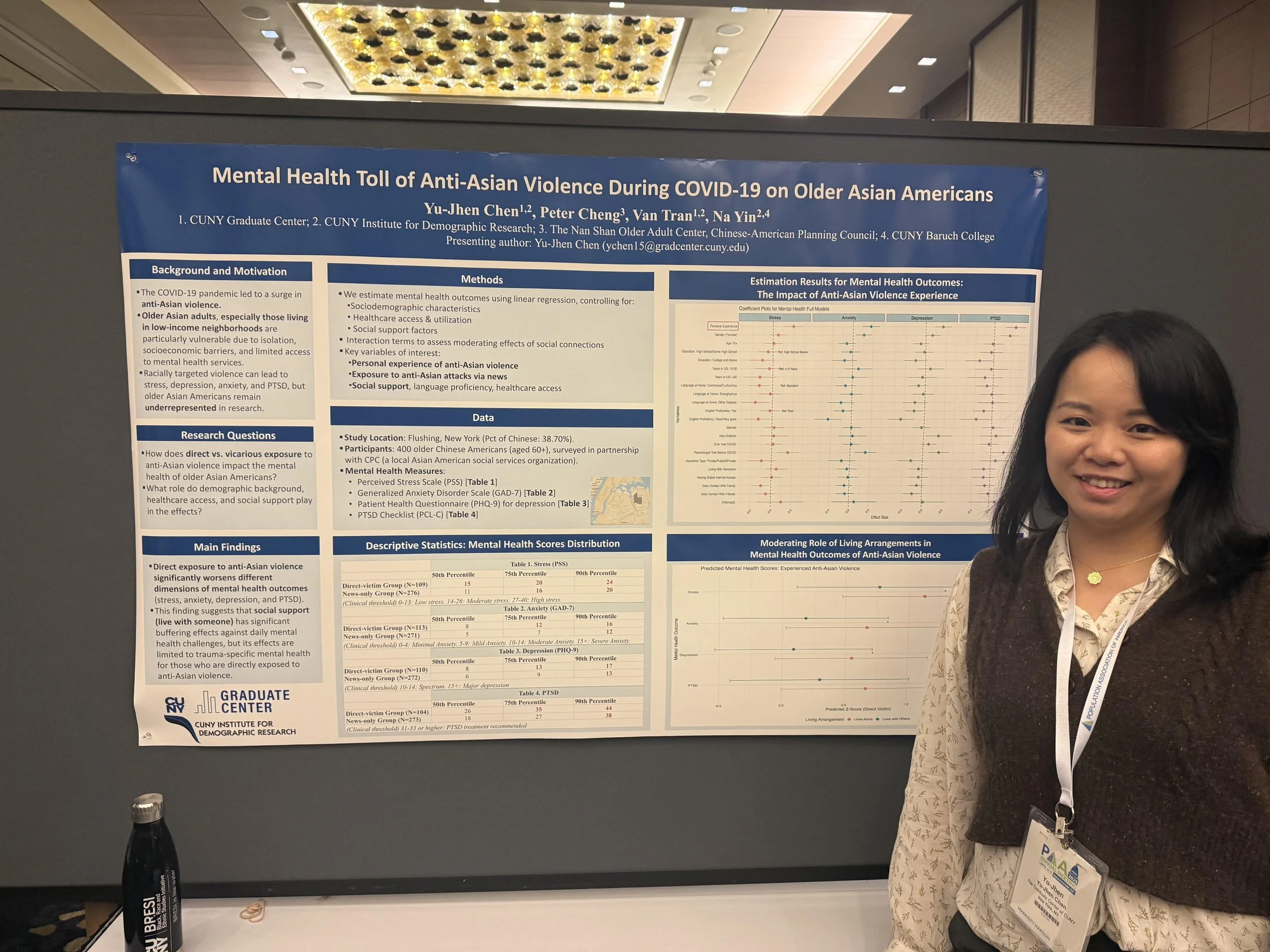

Yu-Jhen Chen presents at PAA

Yu-Jhen Chen at Population Association of America's 2025 conference showcasing their NYRDRC research with Van Tran, & Na Yin, titled "Anti-Asian Violence and Mental Health Outcomes among Low-Income Older Chinese Adults in New York City." Their findings reveal that those personally attacked experienced significantly greater mental health decline, while the news-only group also reported notable distress. This research underscores the severe mental health challenges faced by marginalized Chinese elders during the pandemic and highlights the urgent need for targeted interventions to support their well-being.

-

Jenna Tipaldo presents at PAA

Jenna Tipaldo presented their research with Jennie Kaufman, Jasmine Manalel, Ruth Finkelstein, & Na Yin, "Tracking Health Insurance and Financial Security of Disability Applicants" at the Population Association of America conference

Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) offer crucial support after disability onset, but the application process is lengthy and complex, including a 24-month Medicare waiting period after SSDI eligibility. Without insurance during this time, applicants may face worsening health and financial insecurity, exacerbating pre-existing disparities. Their study asks: How do health insurance and financial security change before and after disability application or rejection? Do SSDI and SSI reduce disadvantage for older adults with disabilities? What role does health insurance play in health outcomes and medical costs?

-

NEW PAPER: A framework for ageing and health vulnerabilities in a changing climate

Jenna Tipaldo, Lori Hunter and Deborah Balk published, “A framework for ageing and health vulnerabilities in a changing climate” in Nature Climate Change. This journal article summarizes ageing trends and the biophysical, sociodemographic, cultural and contextual pathways that shape the disproportionate impacts of climate-related environmental stress on older adults’ health.

-

FORBES: Four Threats To Social Security From Trump Policies

Teresa Ghilarducci outlines the forthcoming risks facing the 72 million retirees, spouses, people with disabilities, children rely on SSA each month.

“The Trump administration – just a few weeks old – has already undermined Social Security with four threats: checks may not be sent on time; drastic cuts in service are planned; transparency and accountability are reduced; and Social Security insolvency is coming sooner.”

-

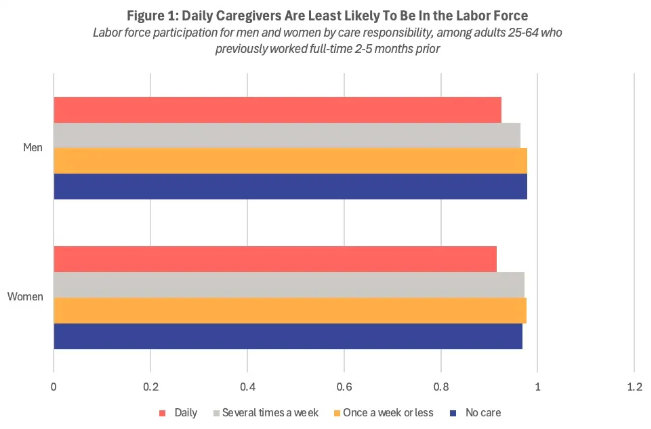

New Article: The relationship between unpaid caregiving and paid work

Jessica Fordon published, The relationship between unpaid caregiving and paid work: Trade-offs in eldercare” in the Academic.

“With an aging population, the demand for Long Term Care is expected to grow significantly. By 2030, the U.S. Census estimates that the number of Americans aged 65 and older will increase from 56.1 million in 2020 (or 17 percent of the total population) to 73.1 million in 2030 (21 percent of the total population). Unpaid caregiving will likely expand, making it critical to understand how it impacts paid work and what factors influence caregivers’ choices and outcomes.”

-

FORBES: It's Jan. 1st and Many Rich Americans Have Already Paid Their 2025 Social Security Taxes

Teresa Ghilarducci discusses the quickest and most effective action to fix Social Security.

“According to public data on Musk’s income, 15 minutes past midnight on New Year’s Eve, he likely has paid all of his Social Security tax on earnings from Tesla. If all of Musk’s income was taxed, he would have been able to pay all his Social Security tax in about 60 seconds.

….

In contrast, over 164 million workers (about 94% of us) pay Social Security taxes all year long. The point is a lot of income escapes the Social Security system; and the escaping income is that from the wealthiest Americans.”

-

New Paper: Understanding deep disadvantage at the end of life

Jennifer Brite, Frank W. Heiland, and Deborah Balk published “Understanding deep disadvantage at the end of life: A nationwide analysis of unclaimed deaths” in Social Science & Medicine. They show how rising rates of unclaimed deaths are associated with county-level indicators of social isolation and economic hardship.

-

Exploring the Role of Digital Trust in Online Interactions with SSA Services by Beneficiaries

Mark Ing and christian gonzález-rivera presented key research findings from their respective NYRDRC studies. The session focused on the barriers faced by older adults—particularly formerly incarcerated and LGBTQ older adults—when trying to access Social Security benefits like OASI, SSDI, and SSI.

-

26th Annual RDRC Meeting

August 7, 2024

Name of panel: Advancing Equity through Structural Barriers Research

Name of Presentation: “Addressing Barriers to Disability Program and SSI Program Participation for Older Formerly Incarcerated Adults”

Ruth K. Finkelstein and christian gonzález-rivera (Hunter College)

Get in touch

Nullam id dolor id nibh ultricies vehicula ut id elit. Cras justo odio, dapibus ac facilisis in, egestas eget quam. Duis mollis, est non commodo luctus, nisi erat porttitor ligula, eget lacinia odio sem nec elit. Nullam id dolor id nibh ultricies vehicula ut id elit.